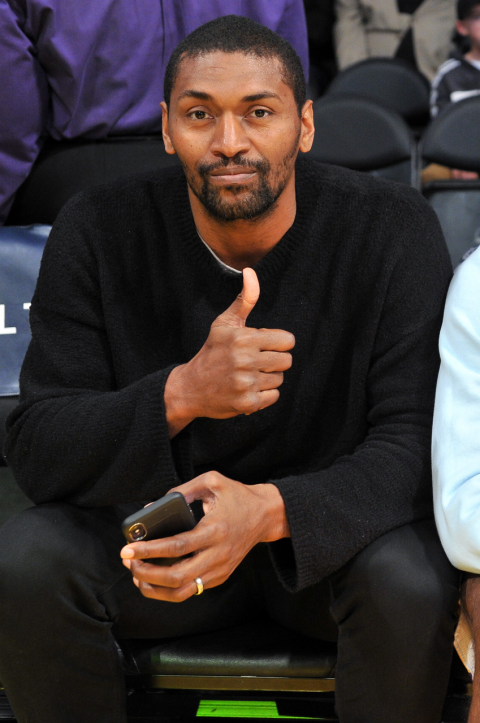

Metta World Peace is nothing short of an icon. His extraordinary NBA career spanned 17 seasons, punctuated by a 2010 championship with the Los Angeles Lakers and a host of accolades, including Defensive Player of the Year, NBA All-Star, All-NBA Third Team (2004), and four All-Defensive Team selections.

Yet, these achievements do not define him, nor are they the legacy he seeks to leave behind. Since stepping away from the game, he has reinvented himself as a philanthropist, mentor, educator, and, above all, a visionary entrepreneur. To date, he has successfully founded over 40 portfolio companies.

His latest initiative, Tru Skye Ventures – named after his granddaughter, Tru, and his partner Steven Stokols' daughter, Skye – endeavors to generate enduring generational wealth through strategic and impactful venture capital investments.

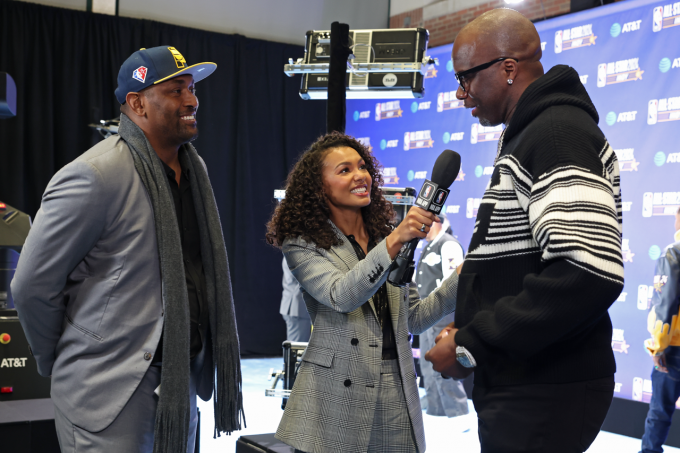

When did you officially launch Tru Skye Ventures?

Metta World Peace: I started it two years ago with my partner Steve Stokols. It took us a little bit of time to build it. It takes a lot to launch a fund. We had to put some things into place, plan deal flow, and then find our thesis.

What inspired you to establish Tru Skye?

MWP: The fund, Tru Skye Ventures, is an offspring of Artest Management Group because we have about 40 portfolio companies and Artest Management Group is more of a service-providing company, and we wanted to take the venture capital model we had with Artest Management Group and give it its own identity, and we did that with True Skye Ventures Fund. Now, we have taken the burden off a venture capital model on top of the service model for Artest Management Group, and we gave it its own entity.